Axis Bank Home Loan Rate Cut

Apply for Axis Bank Home Loan online with interest rates starting at 675 up to 12 EMIs off and no prepayment charges. Explore our wide range of products for the most competitive Home Loan interest.

Pin On 100 Home Loan And Housing Finance Photos And Ideas In India

The interest rate on home loans is also lower than car loans.

Axis bank home loan rate cut

. Union Bank home loan interest rate. The rate cut by Axis Bank was pegged at 15 to 20 basis points resulting in its 1 year loans being available at 905 as compared to SBIs 89. Taking a cue from its larger rivals private sector lender Axis Bank today announced a rate cut of up to 030 per cent for home loan borrowers.For Loans on Base rateMRRBPLR. However RBIs last cut delivered earlier this month has led to a rash of rate cuts by the lenders by up to 010 percent. The move comes a week after the countrys largest lender SBI cut its rates by up to 025 per cent for loans of under Rs 30 lakh.

Axis Bank home loan available at interest rates of 690. Mean rate Sum of rate of interest of all loan accounts Number of all loan accounts. SBI has announced a reduction of 015 on its existing rate to the new rate of 69 for term deposits ranging from 1 year to 455 days.

Our Home Loan affordability calculator is based on your requirements such as tenure loan amount and interest rates to give you an estimate of your EMI. On Tuesday cut its home loan rate for both existing as well as new borrowers by 25 bps to 990 per cent joining a rate cut war triggered by the State Bank of India and HDFC. Axis Bank Home Loans.

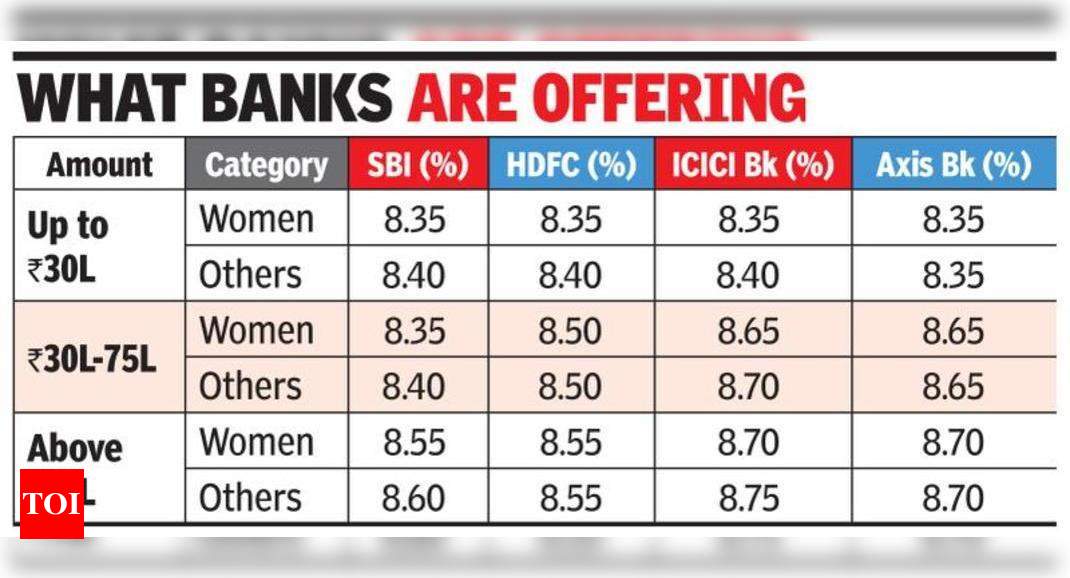

Owning a house and making it into a home is one of the many promises a newly-wed couple make to one another. Axis Bank offers affordable flexible HousingHome Loans online which are available with Nil prepayment charges Low Interest rates Quick processing Flexible repayment which makes your owning experience of dream home. Under the new rates which are effective from May 16 the rate of home loans under Rs 30 lakh by salaried borrowers has been cut by 030 per cent to 835 per cent the bank said in a statement.

After State Bank of India SBI ICICI Bank and HDFC Axis Bank has decided to cut home loan interest rates by 30 basis points bps to 835 percent. Fulfil your dream of owning a home with an affordable housing loan. Simply key in the amount rate and tenure for which the home loan is sought the Home Loan EMI Calculator will automatically reflect the EMIs applicable for the loan tenure.

Our affordable and flexible home loans are designed to take you closer to your dream home. Axis home loan interest rate. With the second wave of the Coronavirus pandemic adversely affecting the economy the Reserve Bank of India RBI on June 4 2021 decided to keep the repo rate unchanged amid.

MCLR rates are reset once every six months. Compared to this car loans a have no tax benefits unless you are self employed. Axis Bank revises MCLR rates on a monthly basis and benchmark its interest rates for home loan and other loans to MCLR rates of different tenors.

For Loans on Marginal Cost based Lending Rate. Originally published on Aug 19 2019. The Banks current base rate is - 835.

HDFC Bank home loan interest rate. Marginal Cost based lending rate is 730. Basic Prime Lending Rate BPLR is 1610.

To opt for a home loan of up to Rs 30 lakh for salaried the rate of interest offered by SBI is 740 per cent effective rate ER HDFC offers it at 785 per cent ICICI Bank offers it at 770 per. Romance aside though purchasing a house or even a small sized flat can be difficult for many and an unattainable dream for others. Borrowers will check Documents Eligibility EMI per lakh Repayment options loan amount prepayment charges online at Deal4loans.

Apply Loan Online at MyLoanCare. Read more about Axis Bank cuts home loan rates by 030 pc on Business Standard. Also remember to refer the amortization table for a year-wise plan of.

It includes various categories like fixed ratefloating rate as applicable and is based on factors such as loan amount customer relationships etc. It can be noted that till the last rate cut of 035 percent the banks have passed out only 029 percent of the 075 percent in rate cuts initiated by the RBI to the final borrowers. Things to keep in mind.

The Mortgage Reference Rate MRR is 1390. Use Axis Banks Home Loan EMI calculator to plan the tenure and repayment structure for your loan. Current MCLR rate of Axis Bank ranges from 715 to 750 varying by reset frequency of the loan.

Axis Bank Asha Home Loan. Therefore its a much better idea to prepay the car loan before the home loan in spite of the prepayment penalty charged on the car loan.

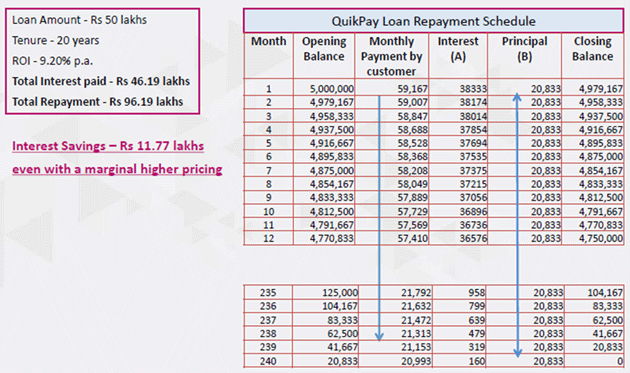

Save Lakhs On Home Loan Here S What You Need To Do Businesstoday

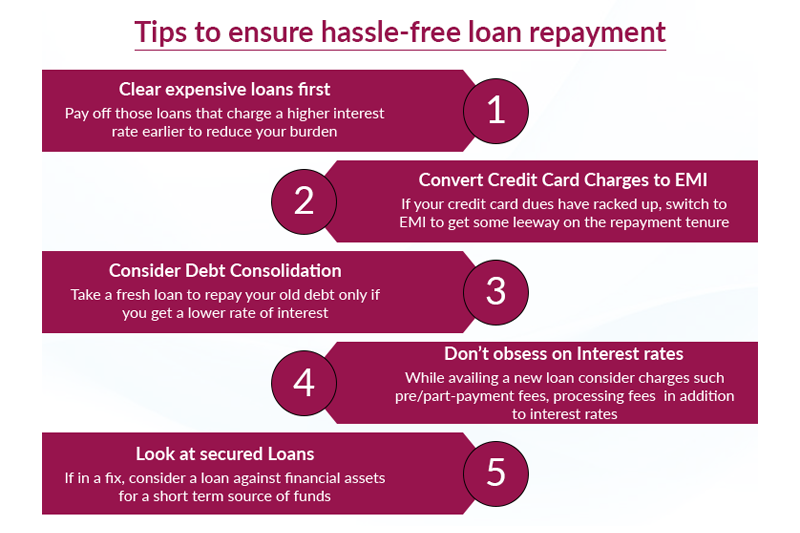

Five Tips To Follow When Planning Loan Repayment

Sbi Cuts Home Loan Rates For Above Rs 75 Lakh Times Of India

Axis Bank Pestle Analysis Pestel Analysis Of Axis Bank Mba Skool Study Learn Share

Axis Bank Home Loan Interest Rates 6 66 Current Axis Bank Housing Loan Rates 2021

Don T Just Consider The Interest Rates When Taking A Home Loan

Post a Comment for "Axis Bank Home Loan Rate Cut"