Dec Monthly Bas Due Date

Q3 January March. 1 July August and September.

Birthdays Bujo Bujojunkies Bulletjournal Bulletjournaljunkies Debbieandreozzi Bujo Cahier Organisation

January February and March.

Dec monthly bas due date

. Monthly BAS Nov 2020 Monthly IAS Nov 2020 31-Dec-2020. When a due date falls on a weekend or public holiday you can make the payment on the next working day. Lodge TFN report for closely held trusts if any beneficiary quoted their TFN to a trustee in Q2 2020-2021.You will also have to lodge a BAS for the quarter that you registered in. Due Date Description. For the financial year ending in 2016 the dates are.

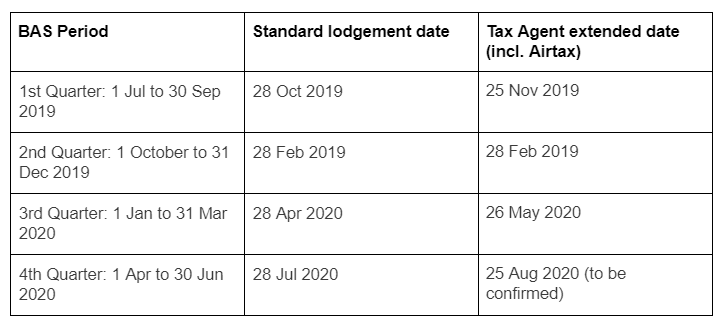

December 2020 Monthly BAS. 1 October to 31 Dec 2020. October to December 2020 Quarterly PAYGI CAS.

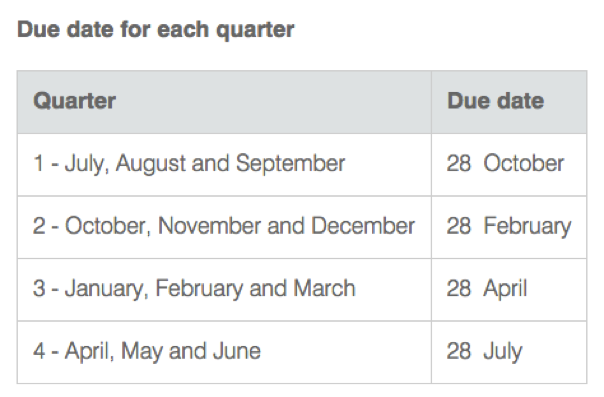

1 January to 31 March 2021. Due date for each quarter. October to December 2020 Quarterly SG.

Monthly Payroll Tax Payment. 4 April May and June. Q1 July September.

January 2017 Monthly Instalment Activity Statement IAS due. Not applicable The electronic lodgment and payment concession does not apply to standard monthly activity statements. Monthly BAS Dec 2020 Monthly IAS Dec 2020 Quarterly PAYGI CAS Oct - Dec 2020 28-Jan-2021.

26 May Lodge and pay Q3 BAS. - Quarter 2 October-December is due on 28 February. The GST due date is a date by which taxpayers are required to file their GST returns without paying any penalty and late fees.

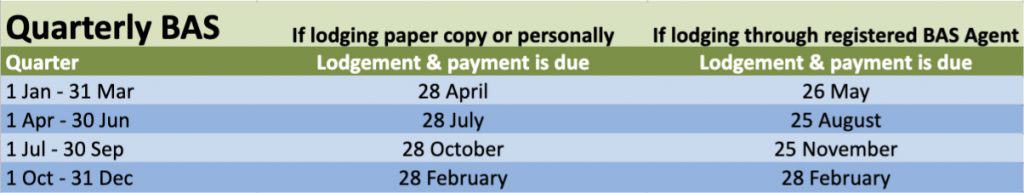

Calculate the number of working days work hours and holidays between two dates in Netherlands. If you have registered for quarterly lodgement periods then your BAS will be due on the 28 th of the month following the quarter. BAS lodgement dates.

Final date due for lodgement and payment 28th February. The due date to lodge and pay your monthly BAS is the 21st day of the month following the end of the taxable period. December Quarter Business Activity Statement BAS due all lodgement types December Quarter PAYG Instalment due.

BAS agent concession for lodgment and payment if lodging by Online services for agents or PLS. October November and December. 21st of the following month.

2 October November and December. Standard due date 28 July 2020 Agent. 21 February Lodge and Pay December 2019 monthly BAS for businesses with 10M turnover 28 February Lodge and Pay Q2 BAS.

If you report and pay monthly the due date is usually on the 21st day of the following month. Quarterly BAS October to December. Monthly Payroll Tax Payment.

Key BAS Due Dates. December 2020 Monthly IAS. July August and September.

Due Date before. - Quarter 1 July-September BAS is due on 28 October. You registered for a quarterly lodgement period on the 31 st of May.

1 July to 30 Sept 2020. April May and June. The taxpayer must submit GST returns within the notified time to ensure that they do not have to pay late fees interest and penalties.

The ATO sets due dates each year for quarterly reporting. For monthly reporting requirements BAS reports are normally due on the 21st day of the following month. 2020-21 BAS quarterly return periods.

Does Walker Hill lodge your Business Activity Statements. Taxable Large Medium Taxpayers return due. January 2021 Monthly BAS.

If your GST turnover is 20 million or more you must report and pay GST monthly and lodge your activity statements online. 2019-20 1 April to 30 June 2020. Standard due date 28 Oct 2020 Agent.

Business Activity Statement BAS Due Dates. 3 January February and March. If ABBS are acting on your behalf we need the necessary information available to us by 14th February.

Country by Country CBC Reporting December year-end JANUARY. Addsubstract daysworking days to a date. GST Due Dates for December 2020.

Q2 October December. For example a July monthly BAS is due on 21 August. If the due date is on a weekend or public holiday you can lodge your form and make any payment due.

- Quarter 3 January-March is due on 28 April. The due date for your monthly BAS is usually the 21st day of the month following the end of the taxable period.

Bas Lodgement Due Dates Swag Bookkeeping

Important Dates For Businesses In 2021 Ledge Finance Ltd

Business Activity Statement When Is Bas Due 2018

Bas Reporting Deadlines Airtax Help Centre

Post a Comment for "Dec Monthly Bas Due Date"